Should we understand “Japanification” as “Boomer Disease”? A view from China

The spectre of “Japanification” is now haunting not only Japan, but also US and Euro zone policy makers. A confounding macroeconomics puzzle since Japan’s economy stalled from mid-1990s, “Japanification” refers to the combination of high and rising government debt, anaemic growth and inflation, and unprecedented monetary loosening, alongside population ageing.

With Japanese central bankers recently, however, confessing that they have mis-diagnosed the cause of “Japanification” for decades, it is imperative that US and Euro zone policy makers don’t repeat their mistake. An important idea from China offers a key to avoiding Japan’s fate.

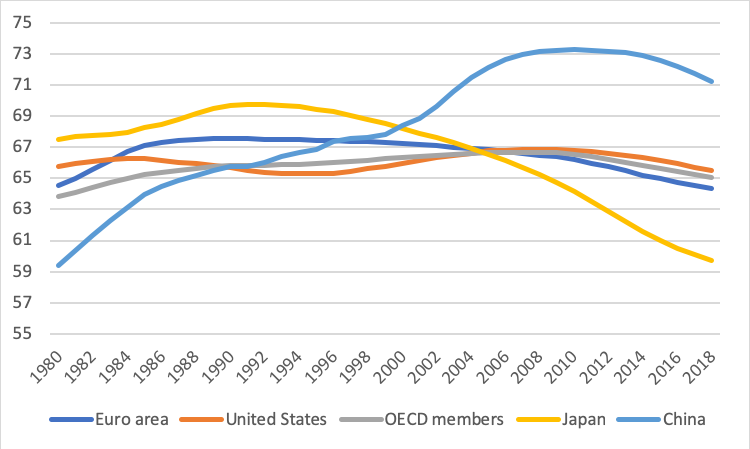

Figure 1 tells the important underlying demographic story. From the 2008 Financial Crisis, most of the world’s major economic centres entered a period in which their working-age population shares would for some decades continue to fall. Such a shift is associated with a set of challenging economic pressure points: falling fiscal resources and higher fiscal burden per capita; falling per capita output and productivity growth; and hence, the risk of economic decline. As dwindling resources become more thinly distributed and contested, deepening political friction is expected also. These are indeed increasingly familiar contemporary circumstances.

Thanks partly to very low immigration, Japan was early to enter and sustain the phase of workforce population share decline (Figure 1). Some two decades later China made the same transition – but as a developing country. Moreover, since China’s making that transition early is linked to its draconian One Child Policy, in fact Chinese policy makers have also been planning ahead for demographic decline for years – they feel responsible for it.

That sense of responsibility, moreover, goes hand-in-hand with the ongoing plan to modernize China’s economy. The combination means that Chinese policy makers alone may have been planning around the combined ebb and flow of the economy and demography, for decades.

For example, in the 1980s and 1990s, the policy focus was on taking explicit advantage of China’s low-wage demographic dividend era. This meant offering investor incentives to set up labour-intensive export-oriented investments in China and setting up a handful of specialised export-oriented clusters in selective locations along the coast to serve them.

Fast forward to today, with wages rising as a result of extraordinarily successful development between, higher education levels and rising labour scarcity thanks to population ageing, investor incentives are instead focused on capital, services and technology-intensive sectors.

Meantime, understanding from the 1980s that China’s workforce population share would begin falling around when it did – long before China had achieved its development goals by any forecast – drove China also to ensure its smaller next cohort of workers were far more educated than those before them. As a result, the young in China are far more educated than the old– a gap that is much less evident in Japan and other high-income country peers. The productivity burden for China’s young of funding all those aged sector needs – health, pensions, and so on – may be easier to manage.

Especially indeed since China’s old were also only ever promised modest pensions – some small fraction of the modest incomes they earned over recent decades, across most of which China itself was a low-income country. Not so in high-income countries, where the reverse scenario is true: the large old cohort have long expected relatively comfortable retirement conditions – regardless of whether this is feasible or fair for the smaller younger cohort to engineer the productivity to make possible.

And hence, in Japan, in the 1990s, as the workforce population share began to fall, and a titan post-War generation’s consumer power began a parallel decline, the diagnosis of central bankers failed. The aggressive use of monetary policy in Japan’s case failed, as former governor the Bank of Japan, Masaaki Shirakawa put it recently, because this “led to perpetually low interest rates because of the very mechanism of monetary easing itself. Its effectiveness derives from bringing forward future demand of private economic agents to the present”.

This is a formula that only works, however, where the economy faces a temporary shortfall in demand. Intensifying – high-income-country – population ageing, is no such temporary shift in aggregate demand patterns. It calls instead for a demographics-friendly approach to finding new sources of per capita productivity.

China has attempted such an approach for decades. To this end, policy makers in China are also aware they are likely to confront a lesser aggregate demand shock than Japan. This is because per capita incomes are rising relatively rapidly in China. Also, the contribution of the consumption of the older population cohort was relatively small over their working lifespan, thanks both to their low incomes and also the structure of China’s then economy. Thus, their shift into retirement is less likely to so adversely affect overall demand.

Within a decade, it will be evident as to whether a newly nationally named set of challenging circumstances, “Japanification”, has set in across the Euro area and in other rapidly ageing high-income economies also. To help avoid that fate, it may be useful to give “Japanification” a more direct name, like “Boomer disease.”

Boomer disease would be the condition arising where the economic windfall of a large demographic cohort adversely distorts the inter-generational economic bargain and productivity potential to such an extent as to ultimately send a country, a region even, into relative decline.

Whether or not the US, the Eurozone and Japan can push through the reforms that better enable new sources of productivity growth and economic vibrancy – in the face of rapid high-income population ageing and the parallel set of economic challenges this is setting off – will depend upon both political will and engagement – across all generations. The alternative is a progressive Boomer Disease-instigated decline.

Microeconomists have long understood the process via which households have managed to elevate living conditions amid transition from high household fertility to low or even no fertility. It is imperative that the macroeconomics community across the high-income democratic world similarly – and imminently – reach an equivalent consensus. Learning from the economic demography transition of middle-income China may help.

Dr Lauren A. Johnston is a Research Associate at the SOAS China Institute.

This article is based on Johnston, L. A. (2019). The Economic Demography Transition: Is China’s ‘Not Rich, First Old’ Circumstance a Barrier to Growth?. Australian Economic Review.

The views expressed on this blog are those of the author(s) and are not necessarily those of the SOAS China Institute.

Originally published on 07 November 2019.

SHARE THIS POST